[ad_1]

Use of algorithmic underwriting is growing throughout the insurance coverage trade. With enhanced decision-making and improved threat assessments, an algorithmic method to underwriting can optimize operations for insurers and expertise for his or her clients.

On this put up we delve into the evolution and benefits of algorithmic underwriting and share our insights on constructing and scaling an algorithmic underwriting platform.

The evolution…

Algorithms have at all times been a part of the underwriting course of, however they’ve typically been restricted to ranking. For instance, in figuring out threat elements for automotive insurance coverage, algorithms, or mathematical formulation, can be used to set charges based mostly on automobile make, mannequin, driver age, location and former historical past. Whether or not easy or advanced, algorithms have lengthy been our core ranking device.

Using algorithms in different areas of the underwriting course of has been restricted as a result of worry of overlapping these elements with price making, or just the dearth of information and analytical capabilities at different components of the underwriting course of to make these selections. As a substitute, the insurance coverage trade has sometimes trusted advanced guidelines engines for selections on threat acceptance, threat tiers and report ordering.

With developments in information entry and analytics instruments, carriers at the moment are rethinking the usage of algorithms, utilizing them both alone or alongside conventional guidelines engines, to reinforce decision-making all through the underwriting course of.

The way it works…

Algorithmic underwriting employs analytical fashions to automate decision-making within the underwriting course of or to supply insights to help underwriters. For extra homogeneous dangers, it will possibly totally or partially automate underwriting.

Key selections made utilizing algorithmic underwriting:

- Figuring out if a submission matches the provider’s threat urge for food

- Figuring out key threat traits resembling the right SIC/NAIC code

- Prioritizing accounts based mostly on desirability and winnability

- Making threat determinations on parts or everything of threat

By this method, carriers can obtain sooner threat acceptance or rejection and cut back underwriting workloads. It additionally helps in offering clients extra personalised threat assessments, real-time threat administration and a seamless expertise.

5 benefits of algorithmic underwriting

Algorithmic underwriting considerably advantages the insurance coverage trade throughout 5 key areas:

- Course of effectivity: By automating the underwriting course of, we’re seeing algorithmic underwriting cut back processing occasions by as much as 50%, streamline operations, enhance testing pace and simplify the upkeep of advanced decision-making techniques. As well as, the automated processes of algorithmic underwriting can assist deal with a rise in purposes reviewed by as much as 25%, enabling insurers to extend premium with out extra working prices.

- Accuracy: The accuracy of threat assessments will be improved by means of evaluation of extra in depth information units. These analyses assist establish patterns and correlations that is perhaps missed by human underwriters alone. With this augmentation of the underwriter’s perception and judgement, errors in threat assessments will be minimized and fraud can extra simply be detected. We estimate fraud losses could also be decreased by as much as 30% for some insurance coverage firms.

- Worth: Pricing selections will be extra correct by enhancing threat assessments. Algorithmic underwriting helps tailor premiums to particular person threat profiles, improve buyer satisfaction and competitiveness. Moreover, it helps dynamic pricing, adjusting premiums in real-time based mostly on altering threat elements, which we see bettering underwriting profitability by as much as 20%.

- Proactive threat administration: Algorithms can assist insurers proactively establish rising dangers and regulate their underwriting and threat administration methods. This can assist to mitigate potential losses, cut back loss ratio and enhance general portfolio efficiency.

- Buyer expertise: Algorithmic underwriting permits for immediate or near-instant selections on protection eligibility, pricing and personalised presents. With predictive and prescriptive analytics, insurers could make real-time, contextualized presents, making insurance coverage extra accessible and related to the person buyer’s wants. It additionally makes insurance coverage extra attainable to clients or segments that will have been marginalized by underwriting strategies of the previous.

Constructing an algorithmic underwriting platform at scale

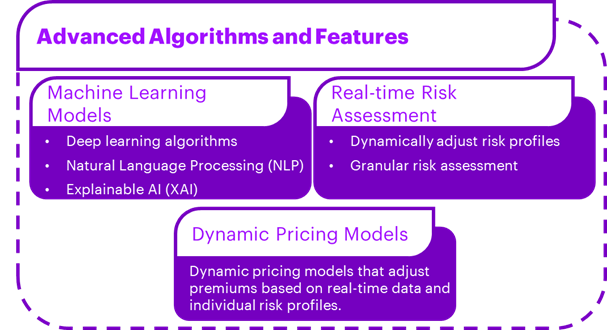

An algorithmic underwriting platform requires a multi-layered method that takes future scalability into consideration. Superior options wanted when contemplating an algorithmic underwriting platform embody machine studying fashions, real-time threat evaluation, and dynamic pricing fashions.

Challenges to contemplate as you optimize your information and algorithmic underwriting platform:

- Information high quality and availability: Information could also be fragmented, incomplete or outdated.

- Mannequin interoperability: Complicated machine studying algorithms used for underwriting might lack transparency and interoperability making outcomes tough to clarify.

- Compliance: As regulation of algorithmic fashions and AI will increase, insurers should keep forward of the steerage and regulate fashions as wanted.

- Equity and bias: If not proactively addressed, algorithmic underwriting presents the danger of perpetuating unfair practices and historic biases.

- Information privateness and safety: Algorithmic underwriting includes amassing, processing and storing massive volumes of non-public and delicate information. Securing buyer information is significant for compliance and sustaining buyer belief.

Success tales…

We see examples of success with algorithmic underwriting throughout the trade. In P&C for instance, Ki Insurance coverage leverages AI and algorithms for immediate industrial insurance coverage quotes and automatic coverage issuance. Hiscox collaborated with Google Cloud to develop and AI mannequin that automates underwriting for particular merchandise. In the meantime, on the life insurance coverage facet, ethos employs machine studying to asses threat and to supply simplified insurance coverage purposes.

Conclusion

Whereas algorithmic underwriting will not be a novel idea in insurance coverage, it’s revolutionary in its enhancement of entry to new information sources, improved information high quality and higher analytics instruments. These enhancements permit underwriters perception from different areas of the worth chain and prolong their functionality past archaic fashions or knockout guidelines.

Regardless of their sophistication, insurers will want to concentrate on the potential for bias and a scarcity of transparency in algorithmic underwriting fashions. Ethics and compliance, together with information privateness, client safety and truthful lending legal guidelines will pose challenges for insurers to deal with from the outset.

As expertise continues to evolve and information analytics capabilities develop, we bear witness to how algorithmic underwriting will revolutionize the insurance coverage trade, drive innovation and empower monetary establishments to make extra knowledgeable, data-driven selections.

[ad_2]

5-areas-of-algorithmic-underwriting-advantage-insurance-blog