[ad_1]

Enterprise Insurance coverage Specialists Pty Ltd has famous ASIC’s steerage to ASX listed firm boards that Local weather Change is a danger that should be mentioned and motion taken. The Australian Institute of Firm Administrators (AICD) as the key physique representing administrators in Australia has additionally taken a pro-active stance in stating that “… local weather change dangers, like different substantial dangers, must be thought of rigorously by boards…”.

From this standpoint, as each ASIC and AICD, consider local weather change is a considerable danger, it is sensible for boards to assessment their danger, and to doc the potential monetary loss that would come up from local weather change, or, in one other phrase from one other period, the chance from adjustments in climate.

The chance must be quantified in your formal danger register throughout the Danger Administration framework of Consequence, Chance and Consequence. To borrow some phrasing from a earlier US Secretary of State in some what totally different circumstances, local weather danger could possibly be termed both a identified unknown, or an unknown identified danger, however it’s not an unknown unknown. Boards do should be discussing this danger.

From a loss management viewpoint, insurance coverage is presumably an under-rated, however easy methodology of guaranteeing that your local weather change, or climate danger, is lowered. With pre-agreed value (premium), payout (declare) based mostly on an agreed occasion (set off), insurance coverage supplies a point of certainty to a board.

As actual examples, you could be a farming organisation the place your yield decreases when rain is lower than anticipated, or Power Retail provider the place gross sales lower if winter is just too gentle, or wind farm the place the wind will not be sufficient or an excessive amount of. These publicity are all climate associated, measurable, and may doubtlessly be insured.

Are any of those climate dangers relevant to your enterprise ?

- Rainfall

- Wind velocity

- Cloud cowl

- Temperature

- Wind Route

- Air Strain

- Evaporation

- Sunshine length

Primarily based on standards together with peril, the set off or parameters, and an agreed greenback quantity whether or not or not it’s based mostly on value of manufacturing, misplaced revenue or complete income, Enterprise Insurance coverage Specialists can help in formulating acceptable cowl in your operations.

From a claims settlement standpoint, a large benefit of this protection is that with no documented proof mandatory of losses past the agreed parameters/triggers, the claims course of is settled in a short time.

Northern Australia insurance coverage market

Lots that has been talked about about adjustments in climate or local weather change lately and the way this compares to the final couple of hundred years of recorded temperatures and climate patterns.

No matter your stance on this subject, climate is a pure phenomenon that results commerce and insurance coverage., and Public boards are required to bear in mind Local weather Change of their determination making.

As insurers at the moment are in a position to ‘worth there danger’ extra precisely by means of higher actuarial pricing fashions, this has led to a dramatic impact on business property and residential insurance coverage prices in Northern Australia.

A aspect impact of getting improved information, is that Insurance coverage in Northern Australia is now considerably extra.

There was a discount in cross subsidies from these positioned in different components of Australia, leading to a lot increased premiums for these in Northern Australia. Insurance coverage has turn out to be extra pretty priced to what the chance is. Nevertheless, to these instantly effected in North Australia sustaining these elevated prices, this has induced extreme ructions.

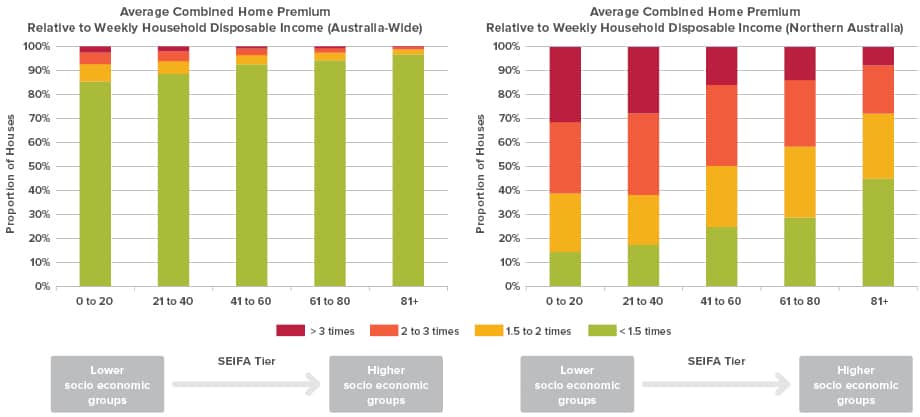

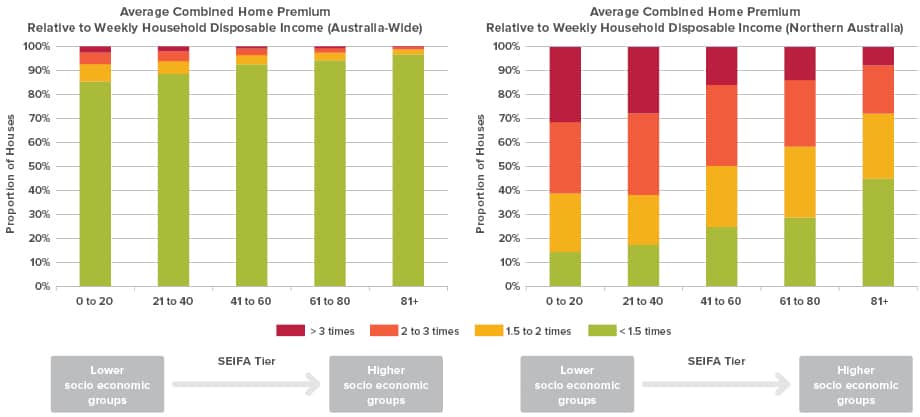

A particularly good examine that adopts a commonsense method in illustrating the prices of insurance coverage Australia-wide versus Northern Australia was undertaken by Finity Consulting. They present the variety of weeks it takes of your disposable revenue to pay in your house and contents insurance coverage additionally bearing in mind socio-economic information.

Graph reveals a measure of affordability created by evaluating our view of common on-line Residence premium to disposable revenue throughout Australia. Every bar represents a quintile of the SEIFA tier. The vertical axis reveals the distribution of homes based mostly on what number of weeks of disposable revenue is required to pay a mean family insurance coverage premium.

In abstract, in extra of 90% of the inhabitants takes lower than two weeks of disposable after-tax revenue to insure your property and contents. In Northern Australia, solely 50% of the inhabitants based mostly on their after tax- revenue take lower than two weeks. It prices way more to insure in North Australia.

The article additional particulars the drivers of the Northern Australia insurance coverage downside, and what may be thought of.

Supply: Finity Consulting, October 28, 2019, Local weather Change and Insurance coverage Affordability

What can Authorities do to cut back monetary loss brought on by Cyclones?

There’s accountability from authorities in any respect ranges, inside their very own monetary constraints of taxes raised and spent, to emphasise mitigation of danger by means of correct constructing codes, city planning and deliberate future rectification of infrastructure requiring enchancment in order to maintain the subsequent main cyclonic occasion.

The function of insurance coverage is a supportive one totally on a reactionary foundation, to make sure if the more serious does occur, that these people or companies who’re accountable and have taken acceptable insurance coverage – at what’s now substantial value – don’t endure a significant monetary loss.

Spending cash on danger mitigation will not be a headline grabbing merchandise for many governments, however finally, the payoff return is enormously lowered prices sooner or later from these which might be each Insured and Uninsured alike, which in truth, is everybody.

[ad_2]

australian-insurers-prepare-for-risks-from-climate-change